Changing money abroad without big fees

parrot_phan

17 years ago

Related Stories

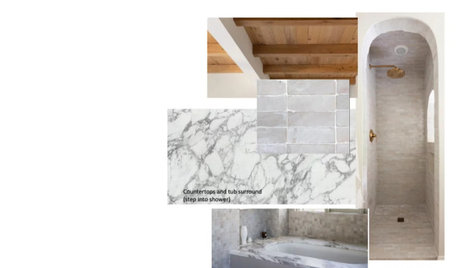

DECORATING GUIDESLook-Alikes That Save Money Without Skimping on Style

Whether in woodwork, flooring, wall treatments or tile, you can get a luxe effect while spending less

Full Story

LIFEHow to Make Your House a Haven Without Changing a Thing

Hung up on 'perfect' aesthetics? You may be missing out on what gives a home real meaning

Full Story

HOME TECHNew TV Remote Controls Promise to Do More — Without the Struggle

Dim your lights, set up user profiles and discover a remote you can't lose. Welcome to the latest and greatest way to change the channel

Full Story

WORKING WITH PROSHow to Hire the Right Architect: Comparing Fees

Learn common fee structures architects use and why you might choose one over another

Full Story

REMODELING GUIDESContractor Fees, Demystified

Learn what a contractor’s markups cover — and why they’re worth it

Full Story

FUN HOUZZDon’t Be a Stickybeak — and Other Home-Related Lingo From Abroad

Need to hire a contractor or buy a certain piece of furniture in the U.K. or Australia? Keep this guide at hand

Full Story

LIFEMake Money From Your Home While You're Away

New services are making occasionally renting your home easier than ever. Here's what you need to know

Full Story

SELLING YOUR HOUSESave Money on Home Staging and Still Sell Faster

Spend only where it matters on home staging to keep money in your pocket and buyers lined up

Full StorySponsored

Columbus Area's Luxury Design Build Firm | 17x Best of Houzz Winner!

bud_wi

steve_o

Related Discussions

Builder Now Trying to Charge Change Order Fee?

Q

Son going to school abroad, how to handle money?

Q

How to get a Living Trust without expensive attorney fees??

Q

How much have homes changed in 100 yrs and can I live without tho

Q

tess_5b

jannie

clg7067

londondi

Rudebekia

TACHE

parrot_phanOriginal Author

steve_o

sharon_sd

User

Meg514