Tax Help for HS Student

sameboat

12 years ago

Related Stories

ARCHITECTUREHouse-Hunting Help: If You Could Pick Your Home Style ...

Love an open layout? Steer clear of Victorians. Hate stairs? Sidle up to a ranch. Whatever home you're looking for, this guide can help

Full Story

ORGANIZINGHelp for Whittling Down the Photo Pile

Consider these 6 points your personal pare-down assistant, making organizing your photo collection easier

Full Story

SELLING YOUR HOUSE5 Savvy Fixes to Help Your Home Sell

Get the maximum return on your spruce-up dollars by putting your money in the areas buyers care most about

Full Story

LIFEHow to Decide on a New Town

These considerations will help you evaluate a region and a neighborhood, so you can make the right move

Full Story

WORKING WITH PROS10 Things Decorators Want You to Know About What They Do

They do more than pick pretty colors. Here's what decorators can do for you — and how you can help them

Full Story

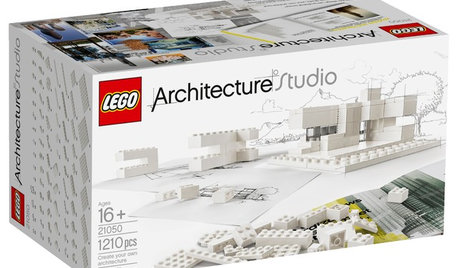

FUN HOUZZWhat Could You Imagine With Lego's New Architecture Kit?

Go ahead, toy around with wild building ideas. With 1,210 all-white blocks at your disposal, it's OK to think big

Full Story

HISTORIC HOMESWright Sized in Alabama: The Rosenbaum House

Get lessons in Usonian living from the design and evolution of a historic Frank Lloyd Wright home

Full Story

FEEL-GOOD HOMEThe Well-Stocked Minimalist

The trick is to have just enough of the right stuff at home — no more, no less. Here’s how to do it

Full Story

FEEL-GOOD HOME9 Smells You Actually Want in Your Home

Boost memory, enhance sleep, lower anxiety ... these scents do way more than just smell good

Full Story

SMALL SPACESGetting a Roommate? Ideas for Making Shared Spaces More Comfortable

Here are tips and tricks for dividing your space so everyone gets the privacy they need

Full StorySponsored

LuAnn_in_PA

mydreamhome

Related Discussions

what to do about taxes, please help!

Q

Differences between HS and College Graduation...

Q

requirements to volunteer coach at H.S

Q

H.S. in Neb--pink uniforms

Q

lazy_gardens

sameboatOriginal Author

dadoes

sameboatOriginal Author

marie_ndcal

sameboatOriginal Author

dadoes

kirkhall

jannie

sameboatOriginal Author