What does it mean when a bank owned home is non-financeable?

TxMarti

10 years ago

Related Stories

MOST POPULARWhen Does a House Become a Home?

Getting settled can take more than arranging all your stuff. Discover how to make a real connection with where you live

Full Story

INSIDE HOUZZHow Much Does a Remodel Cost, and How Long Does It Take?

The 2016 Houzz & Home survey asked 120,000 Houzzers about their renovation projects. Here’s what they said

Full Story

CONTRACTOR TIPSBuilding Permits: When a Permit Is Required and When It's Not

In this article, the first in a series exploring permit processes and requirements, learn why and when you might need one

Full Story

REMODELING GUIDESContractor Tips: What Your Contractor Really Means

Translate your contractor's lingo to get the communication on your home project right

Full Story

REMODELING GUIDES5 Ways to Protect Yourself When Buying a Fixer-Upper

Hidden hazards can derail your dream of scoring a great deal. Before you plunk down any cash, sit down with this

Full Story

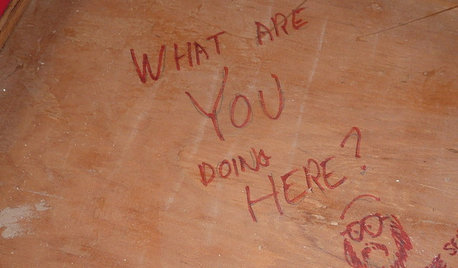

FUN HOUZZDoes Your Home Have a Hidden Message?

If you have ever left or found a message during a construction project, we want to see it!

Full Story

EXTERIOR COLORWhen to Paint Your Home Gray

This perfectly neutral and highly versatile color can create subtle distinctions among exterior architectural elements or stand on its own

Full Story

LANDSCAPE DESIGNMysticism and Meaning Meet in an Ohio Artist’s Gardens

Step into landscape scenes rife with symbolism, inspired by math, philosophy and the stars

Full Story

GARDENING AND LANDSCAPINGHow to Get an Outdoor Kitchen of Your Own

New project for a new year: Build a cooking space for your yard or patio to make entertaining a breeze

Full Story

ARCHITECTURERoots of Style: Does Your House Have a Medieval Heritage?

Look to the Middle Ages to find where your home's steeply pitched roof, gables and more began

Full StoryMore Discussions

GreenDesigns

Mandyvilla

Related Professionals

Holtsville Architects & Building Designers · Morganton Architects & Building Designers · Ronkonkoma Architects & Building Designers · Aurora General Contractors · Banning General Contractors · Berkeley General Contractors · Country Club Hills General Contractors · Enfield General Contractors · Jamestown General Contractors · Mountain View General Contractors · New Bern General Contractors · Towson General Contractors · Warren General Contractors · Watertown General Contractors · Wheaton General Contractorschristopherh

TxMartiOriginal Author

peegee

sylviatexas1

lafdr

ncrealestateguy

mjlb