value of older homes

madeyna

13 years ago

Related Stories

SELLING YOUR HOUSE10 Ways to Boost Your Home's Resale Value

Figure out which renovations will pay off, and you'll have more money in your pocket when that 'Sold' sign is hung

Full Story

GREEN BUILDINGInsulation Basics: Heat, R-Value and the Building Envelope

Learn how heat moves through a home and the materials that can stop it, to make sure your insulation is as effective as you think

Full Story

MOST POPULAR5 Remodels That Make Good Resale Value Sense — and 5 That Don’t

Find out which projects offer the best return on your investment dollars

Full Story

ADDITIONS7 Modern Additions to Older Homes

These contemporary add-ons go their own way as they play off the style of the original

Full Story

DECORATING GUIDES13 Decorating Tips for Older Homes

Preserve the personality of the past while designing for now with these tips for paint, rugs, window treatments and more

Full Story

UNIVERSAL DESIGNHow to Light a Kitchen for Older Eyes and Better Beauty

Include the right kinds of light in your kitchen's universal design plan to make it more workable and visually pleasing for all

Full Story

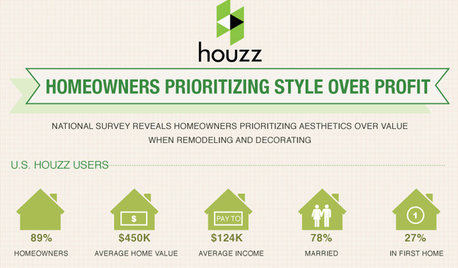

Houzz Survey: Livability Trumps Home Value

Increasing home value comes in a distant second among those planning home improvements. Many plan to do some of the work themselves

Full Story

DECORATING GUIDES10 New Looks for Fireplaces in Older Homes

From updated bricks to modern art on the mantel, these ideas for the fireplace will help your older home feel young at hearth

Full Story

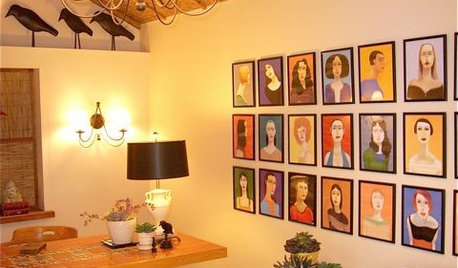

DECORATING GUIDESExpert Talk: Portraits Take Rooms Beyond Face Value

Adding depth and intrigue, portraits also sit well with these pro designers for putting a personal stamp on interior designs

Full Story

MOST POPULARHouzz Tour: Gracious Older Home Updated for a Young Family

A Texas designer lightens up and repurposes rooms, creating a welcoming space that suits this family’s casual lifestyle

Full StoryMore Discussions

OttawaGardener

western_pa_luann

Related Professionals

Charleston Architects & Building Designers · Cloverly Architects & Building Designers · Bell Gardens Architects & Building Designers · Bloomington General Contractors · Channelview General Contractors · Clive General Contractors · Hillsborough General Contractors · Lakeside General Contractors · Markham General Contractors · Mililani Town General Contractors · Palatine General Contractors · Rancho Santa Margarita General Contractors · Valley Station General Contractors · Westerly General Contractors · South Miami Heights Home StagersmadeynaOriginal Author

liriodendron

Billl

eandhl

larke

madeynaOriginal Author