Buy house, rent it out for a year, then move in-Mortgage options?

vamppire

15 years ago

Related Stories

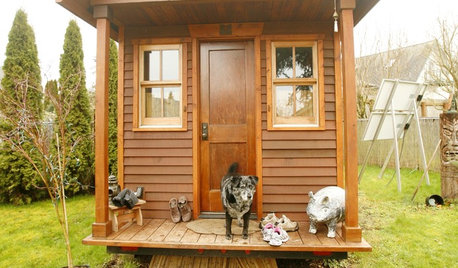

SMALL SPACESLife Lessons From 10 Years of Living in 84 Square Feet

Dee Williams was looking for a richer life. She found it by moving into a very tiny house

Full Story

BATHROOM STORAGE10 Design Moves From Tricked-Out Bathrooms

Cool splurges: Get ideas for a bathroom upgrade from these clever bathroom cabinet additions

Full Story

DECORATING GUIDES10 Easy Fixes for That Nearly Perfect House You Want to Buy

Find out the common flaws that shouldn’t be deal-breakers — and a few that should give you pause

Full Story

MOVINGHome-Buying Checklist: 20 Things to Consider Beyond the Inspection

Quality of life is just as important as construction quality. Learn what to look for at open houses to ensure comfort in your new home

Full Story

SELLING YOUR HOUSEA Moving Diary: Lessons From Selling My Home

After 79 days of home cleaning, staging and — at last — selling, a mom comes away with a top must-do for her next abode

Full Story

MOVINGThe All-in-One-Place Guide to Selling Your Home and Moving

Stay organized with this advice on what to do when you change homes

Full Story

LIFERetirement Reinvention: Boomers Plot Their Next Big Move

Choosing a place to settle in for the golden years? You're not alone. Where boomers are going and what it might look like

Full Story

HOUZZ TOURSMy Houzz: Eclectic, Artistic Rented House in Ojai

Original artwork, vintage furniture and vivid colors saturate a designer's quirky Southern California space. And wait 'til you see the swing

Full Story

HOME INNOVATIONSConsidering Renting to Vacationers? Read This First

More people are redesigning their homes for the short-term-rental boom. Here are 3 examples — and what to consider before joining in

Full Story

LIFE7 Things to Do Before You Move Into a New House

Get life in a new house off to a great start with fresh paint and switch plates, new locks, a deep cleaning — and something on those windows

Full StoryMore Discussions

dave_donhoff

vamppireOriginal Author

Related Professionals

Lafayette Architects & Building Designers · West Palm Beach Architects & Building Designers · Clive General Contractors · Flint General Contractors · Fredonia General Contractors · Groveton General Contractors · Jefferson Valley-Yorktown General Contractors · Mount Vernon General Contractors · Salem General Contractors · Shaker Heights General Contractors · Williamstown General Contractors · Woodland General Contractors · Security-Widefield General Contractors · East Hanover Interior Designers & Decorators · Ogden Interior Designers & Decoratorsjustnigel

vamppireOriginal Author

dave_donhoff