Appraisals

turtleshope

11 years ago

Related Stories

REMODELING GUIDESThe Dos and Don'ts of Home Appraisal

Selling your house? These tips from the pros will help you get the best possible appraisal

Full Story

MOVINGHow to Avoid Paying Too Much for a House

Use the power of comps to gauge a home’s affordability and submit the right bid

Full Story

HOUZZ TOURSHouzz Tour: Resourcefulness Shows in a Rugged Montana Cabin

Reclaimed materials and a simple plan help a carpenter build his own inviting, energy-efficient home

Full Story

SELLING YOUR HOUSEYour Home-Selling Guide for a Faster and Better Sale

Learn staging and curb appeal tricks, how to get the best photos and more in this roundup focusing on high-impact house-selling strategies

Full Story

MOST POPULARHow to Create an Inventory, Whether You're Naturally Organized or Not

Documenting your home items is essential, even if disaster seems unimaginable. And it may be easier than you think

Full Story

HOUZZ TOURSHouzz Tour: Touches of Frank Lloyd Wright in Colorado

From painstakingly crafted trimwork to the 300-pound oak door, the details in this Boulder home pay homage to the Prairie master

Full Story

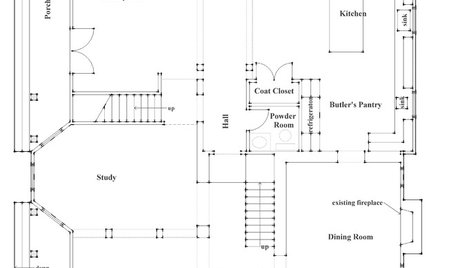

REMODELING GUIDESHow to Read a Floor Plan

If a floor plan's myriad lines and arcs have you seeing spots, this easy-to-understand guide is right up your alley

Full Story

HOME TECHWould You Use Virtual Reality to Renovate Your Home?

Architecture can be confusing, but immersion in a computer-generated 3D world soon may help

Full Story

GREAT HOME PROJECTSWhat to Know Before Refinishing Your Floors

Learn costs and other important details about renewing a hardwood floor — and the one mistake you should avoid

Full Story

SELLING YOUR HOUSEFix It or Not? What to Know When Prepping Your Home for Sale

Find out whether a repair is worth making before you put your house on the market

Full StoryMore Discussions

brickeyee

wagnerpe

Related Professionals

Beachwood Architects & Building Designers · Cloverly Architects & Building Designers · Plainfield Architects & Building Designers · Troutdale Architects & Building Designers · Town and Country Architects & Building Designers · Salem General Contractors · DeKalb General Contractors · Eau Claire General Contractors · Franklin General Contractors · Markham General Contractors · New Carrollton General Contractors · Seal Beach General Contractors · Waterville General Contractors · Kearny Home Stagers · East Hanover Interior Designers & Decoratorskirkhall

azmom

numbersjunkie

brickeyee

sweet.reverie

kats_meow

User

GromitInWA