Rate cuts!!!!

qdognj

15 years ago

Related Stories

MODERN ARCHITECTUREHouzz Tour: Platinum-Rating Hopes for a Sterling Modern Home

Efficiency takes an artful form in a minimalist San Francisco home furnished with iconic and custom pieces

Full Story

MIDCENTURY HOMESHouzz Tour: Small Changes Earn a Top Green Rating

Remodeling for energy efficiency and sustainability within a quaint town's codes wins LEED platinum certification for a midcentury home

Full Story

GARDENING GUIDES7 Ecofriendly Gardening Ideas That Also Cut Chore Time

Spend less time weeding, less money watering and more moments just sitting back and enjoying your healthy garden

Full Story

HOME OFFICESQuiet, Please! How to Cut Noise Pollution at Home

Leaf blowers, trucks or noisy neighbors driving you berserk? These sound-reduction strategies can help you hush things up

Full Story

GREEN BUILDINGWhat's LEED All About, Anyway?

If you're looking for a sustainable, energy-efficient home, look into LEED certification. Learn about the program and its rating system here

Full Story

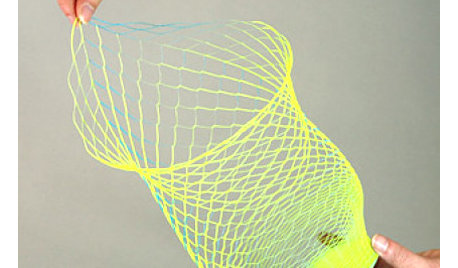

Gift Guide: 50 Flat or Foldable Finds

Make shipping extra easy this holiday with gifts you can send in a flat-rate envelope

Full Story

LANDSCAPE DESIGNPretty Trees for Patios, Paths and Other Tight Spots

Choose trees for their size, shape and rate of growth — or shape them to fit your space. Here's how to get started

Full Story

KITCHEN DESIGN9 Award-Winning Kitchens from KBIS 2013 to Drool Over

See top-rated designs from this year's Kitchen and Bath Industry Show and get details about the designers' visions

Full Story

GREAT HOME PROJECTSHow to Install Energy-Efficient Windows

Learn what Energy Star ratings mean, what special license your contractor should have, whether permits are required and more

Full Story

BATHROOM DESIGN6 Elements of a Perfect Bathroom Paint Job

High-quality paint alone won't cut it. For the best-looking painted bathroom walls, you'll need to get these other details right

Full StoryMore Discussions

User

galore2112

Related Professionals

Vancouver Architects & Building Designers · Alamo General Contractors · Ashburn General Contractors · Augusta General Contractors · Burlington General Contractors · Coffeyville General Contractors · Coronado General Contractors · Elmont General Contractors · Markham General Contractors · Montclair General Contractors · Saint Andrews General Contractors · Wallington General Contractors · Wheeling General Contractors · Fitchburg Home Stagers · Mount Vernon Interior Designers & DecoratorsqdognjOriginal Author

deniseandspike

User

User

jane__ny

logic

galore2112

bushleague

qdognjOriginal Author

galore2112

qdognjOriginal Author

triciae

qdognjOriginal Author

mfbenson