The closing that probably won't happen

alisonn

10 years ago

Related Stories

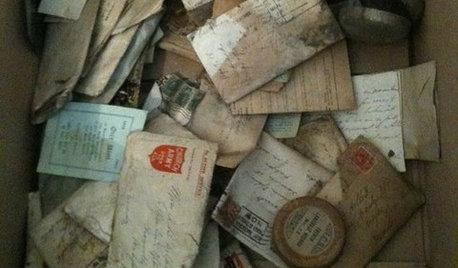

REMODELING GUIDESYou Won't Believe What These Homeowners Found in Their Walls

From the banal to the downright bizarre, these uncovered artifacts may get you wondering what may be hidden in your own home

Full Story

ARCHITECTURESee the Daring Experimentalist Who Won 2013's Pritzker Prize

Architecture's highest honor goes to someone with a diverse and complex body of work and a never-satisfied mind-set

Full Story

KITCHEN DESIGNHave Your Open Kitchen and Close It Off Too

Get the best of both worlds with a kitchen that can hide or be in plain sight, thanks to doors, curtains and savvy design

Full Story

KITCHEN DESIGNOpen vs. Closed Kitchens — Which Style Works Best for You?

Get the kitchen layout that's right for you with this advice from 3 experts

Full Story

BATHROOM DESIGNLittle Luxuries: Get Ready for Your Close-up With Lighted Mirrors

Get a better view applying makeup, shaving or dressing, with mirrors that put light right where you need it

Full Story

BEFORE AND AFTERSKitchen Rehab: Don’t Nix It, Fix It

A small makeover makes a big impact in a traditional kitchen in Atlanta with great bones

Full Story

PETS5 Finishes Pets and Kids Can’t Destroy — and 5 to Avoid

Save your sanity and your decorating budget by choosing materials and surfaces that can stand up to abuse

Full Story

FUN HOUZZ10 Things People Really Don’t Want in Their Homes

No love lost over fluorescent lights? No shocker there. But some of these other hated items may surprise you

Full Story

LIVING ROOMSLiving Rooms That Don’t Revolve Around the TV

In these spaces, the television takes a back seat to conversation, relaxation and aesthetics

Full Story

DECLUTTERINGDecluttering — Don't Let Fear Hold You Back

Sure, you might make a mistake when tackling a decluttering project, but that's OK. Here's why

Full Story

function_first

egbar

Related Professionals

Madison Heights Architects & Building Designers · Arlington General Contractors · Athens General Contractors · Belleville General Contractors · Dunedin General Contractors · Hillsboro General Contractors · McPherson General Contractors · Medford General Contractors · Seguin General Contractors · Sulphur General Contractors · Uniondale General Contractors · View Park-Windsor Hills General Contractors · Warren General Contractors · Wolf Trap General Contractors · Wanaque Interior Designers & Decoratorskjdnns

xamsx

invisible_hand

kirkhall