Changing names on grant deed

persnippity

14 years ago

Related Stories

RANCH HOMESHouzz Tour: Ranch House Changes Yield Big Results

An architect helps homeowners add features, including a new kitchen, that make their Minnesota home feel just right

Full Story

LIFESurprising Ways to Pare Down at Home

All those household items you take for granted? You might not need them after all. These lists can help you decide

Full Story

LIFETrue Confessions of a House Stalker

Letting go when a new owner dares to change a beloved house's look can be downright difficult. Has this ever happened to you?

Full Story

LIFE10 Ways to Cope With Grief During the Holidays

If you are experiencing loss, take it from an experienced griever — life has changed forever, but it does get better

Full Story

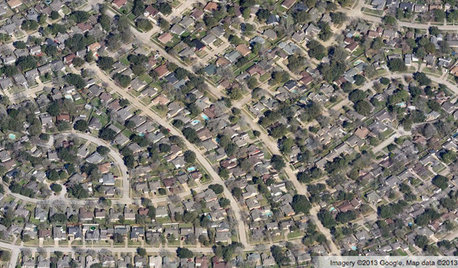

COMMUNITYGet a Bird's-Eye View of America's Housing Patterns

See the big picture of how suburban developments are changing the country's landscape, with aerial photos and ideas for the future

Full Story

MOVINGThe All-in-One-Place Guide to Selling Your Home and Moving

Stay organized with this advice on what to do when you change homes

Full Story

LIFEHave the Kids Left Home? 16 Things to Consider

‘An empty nest is not an empty heart’ and other wisdom for when the household changes

Full Story

DECORATING GUIDES15 Home Ideas Fit for a Crowd

Spend less time corralling chaos and more time enjoying family togetherness with this advice from someone who's been there

Full Story

ECLECTIC HOMESHouzz Tour: Farmhouse Retreat With a Sophisticated Edge

Humor is part of the mix in a Pennsylvania weekend house decorated with antiques, art and repurposed vintage farm items

Full Story

TRADITIONAL ARCHITECTUREHow to Research Your Home's History

Learn what your house looked like in a previous life to make updates that fit — or just for fun

Full Story

mariend

sylviatexas1

Related Professionals

Saint James Architects & Building Designers · The Crossings General Contractors · Geneva General Contractors · Holly Hill General Contractors · Marietta General Contractors · Perrysburg General Contractors · Riverdale General Contractors · Rossmoor General Contractors · Watertown General Contractors · Wright General Contractors · Buffalo Home Stagers · Kansas City Home Stagers · La Habra Interior Designers & Decorators · Stanford Interior Designers & Decorators · Liberty Township Interior Designers & Decoratorscreek_side

blueheron

creek_side

C Marlin

devorah

brickeyee

kelpmermaid

sylviatexas1

mary_md7

brickeyee