Closing questions - wire transfer of funds, utilities, etc

jenswrens

14 years ago

Related Stories

SELLING YOUR HOUSE15 Questions to Ask When Interviewing a Real Estate Agent

Here’s what you should find out before selecting an agent to sell your home

Full Story

MOVINGHiring a Home Inspector? Ask These 10 Questions

How to make sure the pro who performs your home inspection is properly qualified and insured, so you can protect your big investment

Full Story

REMODELING GUIDESSurvive Your Home Remodel: 11 Must-Ask Questions

Plan ahead to keep minor hassles from turning into major headaches during an extensive renovation

Full Story

LIGHTING5 Questions to Ask for the Best Room Lighting

Get your overhead, task and accent lighting right for decorative beauty, less eyestrain and a focus exactly where you want

Full Story

KITCHEN DESIGNHave Your Open Kitchen and Close It Off Too

Get the best of both worlds with a kitchen that can hide or be in plain sight, thanks to doors, curtains and savvy design

Full Story

KITCHEN DESIGNOpen vs. Closed Kitchens — Which Style Works Best for You?

Get the kitchen layout that's right for you with this advice from 3 experts

Full Story

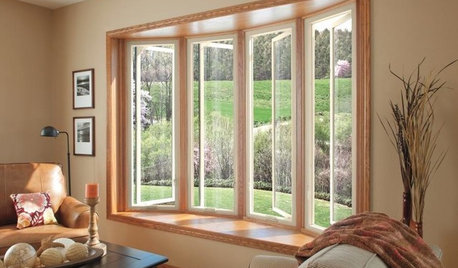

GREAT HOME PROJECTSUpgrade Your Windows for Beauty, Comfort and Big Energy Savings

Bid drafts or stuffiness farewell and say hello to lower utility bills with new, energy-efficient windows

Full Story

REMODELING GUIDESGet the Look of a Built-in Fridge for Less

So you want a flush refrigerator but aren’t flush with funds. We’ve got just the workaround for you

Full Story

ARTCollect With Confidence: An Art-Buying Guide for Beginners

Don't let a lack of knowledge or limited funds keep you from the joy of owning art. This guide will put you on the collector's path

Full Story

graywings123

mariend

Related Professionals

Plainville Architects & Building Designers · Goodlettsville General Contractors · Boardman General Contractors · Florham Park General Contractors · Green Bay General Contractors · Groveton General Contractors · Mankato General Contractors · Montclair General Contractors · Pepper Pike General Contractors · Saginaw General Contractors · San Marcos General Contractors · Winfield General Contractors · Mableton Home Stagers · Spokane Home Stagers · Centerville Interior Designers & Decoratorsmooie

c9pilot

rachelh

jenswrensOriginal Author

landmarker

brickeyee

annainpa

emilynewhome

cda44

ncrealestateguy

pedromont2_yahoo_com

barbcollins