Home Path Renovation Mortgage

Susan20148

11 years ago

Related Stories

HOUZZ TOURSMy Houzz: City and Country Cross Paths in a Dutch Villa

It backs onto a lushly planted waterway and even has a pool, but this Netherlands home never loses sight of its capital skyline

Full Story

ARCHITECTURERanch House Love: Inspiration From 13 Ranch Renovations

Kick-start a ranch remodel with tips based on lovingly renovated homes done up in all kinds of styles

Full Story

PATIOSLandscape Paving 101: How to Use Brick for Your Path or Patio

Brick paving is classy, timeless and a natural building material. Here are some pros and cons to help you decide if it’s right for your yard

Full Story

REMODELING GUIDESPlan Your Home Remodel: The Interior Renovation Phase

Renovation Diary, Part 4: Peek in as the team opens a '70s ranch home to a water view, experiments with paint and chooses tile

Full Story

HOUZZ TOURSHouzz Tour: Major Renovations Aid a Usonian Home

Its classic lines got to stay, but this 1950s home's outdated spaces, lack of privacy and structural problems got the boot

Full Story

SELLING YOUR HOUSEThe Latest Info on Renovating Your Home to Sell

Pro advice about where to put your remodeling dollars for success in selling your home

Full Story

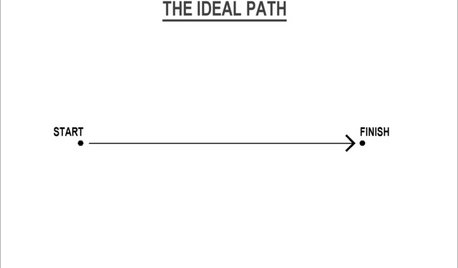

MOST POPULARThe Many Paths of Design, Part 1

Blame engineering issues, unforeseen revisions or even the Internet. As these diagrams show, it's probably not your fault

Full Story

CRAFTSMAN DESIGNHouzz Tour: Thoughtful Renovation Suits Home's Craftsman Neighborhood

A reconfigured floor plan opens up the downstairs in this Atlanta house, while a new second story adds a private oasis

Full Story

REMODELING GUIDESNew Home Renovation Study Paints Positive Growth Picture

More than two-thirds of industry professionals say 2014 was a good year and 2015 is looking hopeful

Full Story

MODERN ARCHITECTUREHouzz Tour: A Modern Renovation in a Colonial-Era Town

Listed as a teardown, a midcentury modern home with harbor views gets a second chance, thanks to one local family

Full Story

c9pilot

User

Susan20148Original Author

writersblock (9b/10a)

kkllb