land contract or bankruptcy

west9491

13 years ago

Related Stories

CONTRACTOR TIPSWhat to Look for in a Contractor's Contract

10 basic ingredients for a contract will help pave the way to remodel happiness

Full Story

BUDGETING YOUR PROJECTConstruction Contracts: What Are General Conditions?

Here’s what you should know about these behind-the-scenes costs and why your contractor bills for them

Full Story

BUDGETING YOUR PROJECTConstruction Contracts: What to Know About Estimates vs. Bids

Understanding how contractors bill for services can help you keep costs down and your project on track

Full Story

WORKING WITH PROSConstruction Contracts: How to Understand What You Are Buying

Learn how plans, scope of work and specifications define the work to be completed

Full Story

HOUZZ CALLShow Us the Best Kitchen in the Land

The Hardworking Home: We want to see why the kitchen is the heart of the home

Full Story

THE ART OF ARCHITECTUREFinding the Perfect Home for a New House

Sun, soil, water, topography and more offer important cues to siting your house on the land

Full Story

HOUZZ TOURSMy Houzz: Charming, Beautiful Renovated Victorian

A couple gives a 19th century home in Poughkeepsie, N.Y. a modern footprint

Full Story

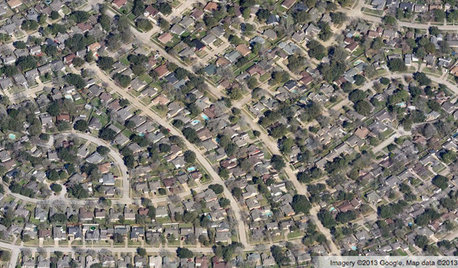

COMMUNITYGet a Bird's-Eye View of America's Housing Patterns

See the big picture of how suburban developments are changing the country's landscape, with aerial photos and ideas for the future

Full Story

HOUZZ TOURSHouzz Tour: Big Bay Views Buoy a Seattle Floating Home

Two glass sides bring spectacular scenes into this newly industrial modern home on the water

Full Story

CONTRACTOR TIPS10 Things to Discuss With Your Contractor Before Work Starts

Have a meeting a week before hammers and shovels fly to make sure everyone’s on the same page

Full Story

OttawaGardener

terezosa / terriks

Related Professionals

San Angelo Architects & Building Designers · Amarillo General Contractors · Catonsville General Contractors · De Pere General Contractors · Easley General Contractors · Ken Caryl General Contractors · Northfield General Contractors · Pico Rivera General Contractors · Shorewood General Contractors · Syosset General Contractors · Valle Vista General Contractors · Valley Station General Contractors · Annapolis Home Stagers · South Miami Heights Home Stagers · Nashville Interior Designers & Decoratorsmarie_ndcal

LoveInTheHouse

badgergrrl

weedyacres

brickeyee

LoveInTheHouse

brickeyee