anyone who is a landlord, could you help, please with tax info

susie100

15 years ago

Related Stories

LIFECould You Be a Landlord?

Sure, the extra income would be great. But jumping blindly into owning a rental property could be disastrous. Here's what you need to know

Full Story

CLOSETSThe Cure for Houzz Envy: Closet Touches Anyone Can Do

These easy and inexpensive moves for more space and better organization are right in fashion

Full Story

KITCHEN DESIGNThe Cure for Houzz Envy: Kitchen Touches Anyone Can Do

Take your kitchen up a notch even if it will never reach top-of-the-line, with these cheap and easy decorating ideas

Full Story

HOME OFFICESThe Cure for Houzz Envy: Home Office Touches Anyone Can Do

Borrow these modest design moves to make your workspace more inviting, organized and personal

Full Story

HOME OFFICESQuiet, Please! How to Cut Noise Pollution at Home

Leaf blowers, trucks or noisy neighbors driving you berserk? These sound-reduction strategies can help you hush things up

Full Story

GARDENING GUIDESGreat Design Plant: Ceanothus Pleases With Nectar and Fragrant Blooms

West Coast natives: The blue flowers of drought-tolerant ceanothus draw the eye and help support local wildlife too

Full Story

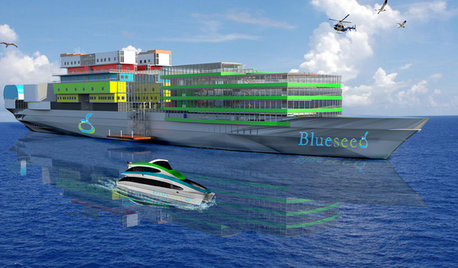

LIFECould Techies Get a Floating Home Near California?

International companies would catch a big business break, and the apartments could be cool. But what are the odds of success? Weigh in here

Full Story

LIVING ROOMSCurtains, Please: See Our Contest Winner's Finished Dream Living Room

Check out the gorgeously designed and furnished new space now that the paint is dry and all the pieces are in place

Full Story

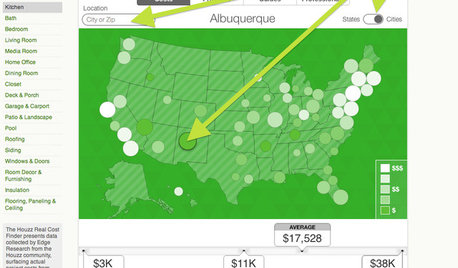

REMODELING GUIDESBreakthrough Budgeting Info: The Houzz Real Cost Finder Is Here

Get remodeling and product prices by project and U.S. city, with our easy-to-use interactive tool

Full Story

HOW TO PHOTOGRAPH YOUR HOUSECould You Be the Next My Houzz Photographer?

Do you love to photograph interesting homes and write about interior design? We want to talk with you

Full Story

mariend

nutbunch

Related Professionals

Palos Verdes Estates Architects & Building Designers · Palos Verdes Estates Architects & Building Designers · Panama City Beach Architects & Building Designers · Panama City Beach Architects & Building Designers · Bell General Contractors · Cumberland General Contractors · Hutchinson General Contractors · Klamath Falls General Contractors · Kyle General Contractors · Palestine General Contractors · River Forest General Contractors · Van Buren General Contractors · Spokane Home Stagers · Mount Vernon Interior Designers & Decorators · Liberty Township Interior Designers & Decoratorssusie100Original Author

brickeyee

sadiesmom

nutbunch

susanlynn2012

brickeyee

susanlynn2012

brickeyee

jlhug

brickeyee

susanlynn2012

jlhug

susanlynn2012