Is this Fair?

goldy

15 years ago

Related Stories

DIY PROJECTSAre You a Maker? There's a Fair for You

Get inspired, show your work or just enjoy the amazing creativity at events around the world devoted to the art of hand crafting

Full Story

EVENTSMaker Faire: The Future Is Now

Kid-friendly robots and high-tech sprinkling systems: This fair shows what’s new and next

Full Story

SHOP HOUZZShop Houzz: Chicago World’s Fair

Explore the dawn of modern fairs and carnivals with this collection inspired by the Columbian Exposition

Full Story0

EVENTSMaker Faire: Pancake Printers, an Electric Giraffe and So Much More

Passionate makers bring their latest wares to an annual festival where creativity meets tech

Full Story

EVENTSTreasure Hunting at the Brimfield Antiques Fair

More than 5,000 antiques dealers are selling their goods along a 1-mile stretch of rural New England this week. Here's what we found

Full Story

BATHROOM DESIGNWhite Bathrooms: Fair Game for Every Design Style

Whether traditional marble rocks your world or romantic skirted vanity seats set your heart aflutter, there's a white bathroom for you

Full Story

PRODUCT PICKSGuest Picks: Get Antiques-Fair Style Right From Home

Spare yourself the crowds and heat of Antique Weekend in Texas by picking up these similar-style finds online

Full Story

TASTEMAKERSSneak Peek: 10 Visionary Designs That Could Be Coming Your Way

Trust the next generation of designers to think ahead — these promising products from the imm Cologne trade fair take innovation to heart

Full Story

EVENTSMiami Art Week Kicks Off December in Style

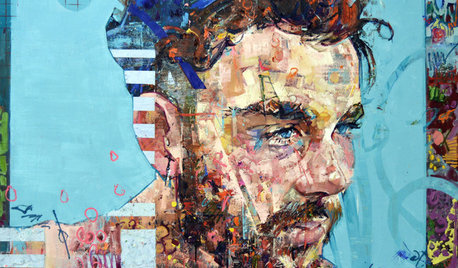

Celebrate all things art as Art Miami, Art Basel Miami and other fairs take over Miami Beach

Full Story

FURNITUREUpholstery in 3D Comes to ICFF 2013

Laminate triangles put this award-winning chair ahead of the curve at a New York City furniture fair

Full StorySponsored

Custom Craftsmanship & Construction Solutions in Franklin County

More Discussions

western_pa_luann

chris8796

Related Discussions

Speaking of World Fairs.... link to pictures of the 1904 Fair

Q

$14/sq ft installed coretec grande fair?

Q

Is $165 per outlet a fair price in Southern California?

Q

Does Anyone Grow Fair Molly?

Q

goldyOriginal Author

western_pa_luann

arizonarose

jane__ny

jakkom

western_pa_luann

harriethomeowner

User

triciae

western_pa_luann

ladytexan

joyfulguy

mary_c_gw

goldyOriginal Author

western_pa_luann

goldyOriginal Author

mary_c_gw

goldyOriginal Author

triciae

Chemocurl zn5b/6a Indiana

goldyOriginal Author

mustangs81

goldyOriginal Author