E loan savings account

blue_fastback

17 years ago

Related Stories

KITCHEN DESIGN9 Ways to Save on Your Kitchen Remodel

A designer shares key areas where you can economize — and still get the kitchen of your dreams

Full Story

SAVING WATER11 Ways to Save Water at Home

Whether you live in a drought-stricken area or just want to help preserve a precious resource, here are things you can do to use less water

Full Story

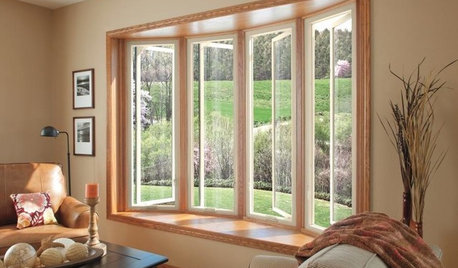

GREAT HOME PROJECTSUpgrade Your Windows for Beauty, Comfort and Big Energy Savings

Bid drafts or stuffiness farewell and say hello to lower utility bills with new, energy-efficient windows

Full Story

SAVING WATER6 Reasons Why You Should Save Your Rainwater Now

Collect and store during the rainy season so you’ll have water ready for irrigation when you need it

Full Story

SMALL HOMESAsk an Expert: What Is Your Ultimate Space-Saving Trick?

Houzz professionals share their secrets for getting more from any space, small or large

Full Story

BATHROOM DESIGNWater Damage Spawns a Space-Saving Bathroom Remodel

A game of inches saved this small New York City bathroom from becoming too cramped and limited

Full Story

MODERN ARCHITECTUREKeep Your Big Windows — and Save Birds Too

Reduce bird strikes on windows with everything from architectural solutions to a new high-tech glass from Germany

Full Story

ARCHITECTURE4 Things a Hurricane Teaches You About Good Design

When the power goes out, a home's design can be as important as packaged food and a hand-crank radio. See how from a firsthand account

Full Story

GREEN BUILDINGHouzz Tour: Going Completely Off the Grid in Nova Scotia

Powered by sunshine and built with salvaged materials, this Canadian home is an experiment for green building practices

Full Story

GREEN BUILDING4 Ways Green Roofs Help Manage Stormwater

See how a living roof of any size can have a big impact

Full StorySponsored

More Discussions

joyfulguy

joyfulguy

Related Discussions

WSJ commentary on personal accountability

Q

Maybe change loan interest paid from non-deductible to deductible

Q

Trying to save my marriage...Advice?

Q

Car purchase & loan advice needed

Q

alphacat

missjulied