When to Start Social Security

C Marlin

16 years ago

Related Stories

DECORATING GUIDESHow to Decorate When You're Starting Out or Starting Over

No need to feel overwhelmed. Our step-by-step decorating guide can help you put together a home look you'll love

Full Story

HOME TECHHigh-Tech Tips for Securing Your House While You're Away

Prevent burglaries when you're traveling by using the latest gadgets, apps and online services

Full Story

ARCHITECTUREDesign Practice: How to Start Your Architecture Business

Pro to pro: Get your architecture or design practice out of your daydreams and into reality with these initial moves

Full Story

FARM YOUR YARD6 Things to Know Before You Start Growing Your Own Food

It takes time and practice, but growing edibles in the suburbs or city is possible with smart prep and patience

Full Story

GARDENING AND LANDSCAPINGTake Back Your Front Yard: 8 Ways to Make It Social

If only trees and squirrels gather in your front yard, you're missing out on valuable socializing space. Here's how to remedy that

Full Story

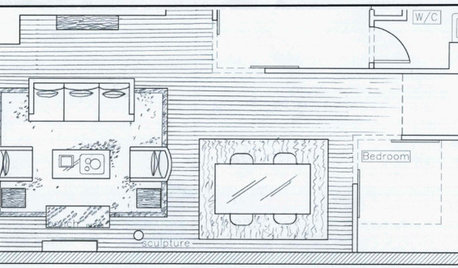

DECORATING GUIDES9 Planning Musts Before You Start a Makeover

Don’t buy even a single chair without measuring and mapping, and you’ll be sitting pretty when your new room is done

Full Story

DESIGN PRACTICEDesign Practice: Start-up Costs for Architects and Designers

How much cash does it take to open a design company? When you use free tools and services, it’s less than you might think

Full Story

CONTRACTOR TIPSBuilding Permits: When a Permit Is Required and When It's Not

In this article, the first in a series exploring permit processes and requirements, learn why and when you might need one

Full Story

HOUSEKEEPINGWhen You Need Real Housekeeping Help

Which is scarier, Lifetime's 'Devious Maids' show or that area behind the toilet? If the toilet wins, you'll need these tips

Full Story

MOST POPULARWhen Does a House Become a Home?

Getting settled can take more than arranging all your stuff. Discover how to make a real connection with where you live

Full StorySponsored

More Discussions

zone_8grandma

chisue

Related Discussions

My Christmas present from Social Security

Q

When to take Social Security?

Q

Social Security

Q

social security

Q

acey

chisue

terrig_2007

celticmoon

Jonesy

chisue

susie53_gw

Tashina Knight

celticmoon

dave100

zone_8grandma

dave100

celticmoon