Current Market downturn

Jim

16 years ago

Related Stories

MOVINGTips for Winning a Bidding War in a Hot Home Market

Cash isn’t always king in a bidding war. Get the home you want without blowing your budget, using these Realtor-tested strategies

Full Story

Emerald - Las Vegas Market 2013

A showcase of noteworthy products against the backdrop of this year's Pantone Color of the Year

Full Story

ACCESSORIESHigh Point Market Branches Out Into Natural Decor

Branches, driftwood, shells and sustainable materials were big trends in decor items at the 2012 High Point Market. Take a peek here

Full Story

DECORATING GUIDESBook to Know: 'Flea Market Chic'

Think flea market finds are just old junk not fit for a modern home? If so, it's time for a read and a rethink

Full Story

EVENTS5 Big Trends From This Week’s High Point Market

Learn the colors, textures and shapes that are creating a buzz in interior design at the market right now

Full Story

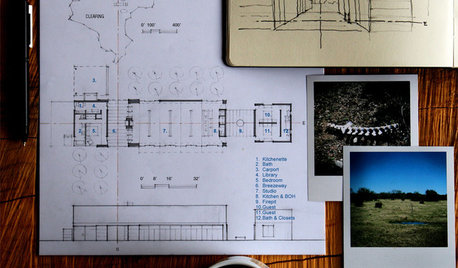

ARCHITECTUREDesign Practice: The Basics of Marketing Your Business

Pro to pro: Attract clients and get paying work by drawing attention to your brand in the right places

Full Story

ACCESSORIESHow to Really Score at the Flea Market

To snag the best deals from arrival to departure, follow these tried and true guidelines from an insider

Full Story

COLLECTIONSFlea Market Find: Brass Creatures Warm Up the Room

Work some classic bling into your home with these 10 ideas

Full Story

COTTAGE STYLEDecorating a Cottage? Think Flea Market Style

Hit up swap meets and junk shops for furniture that’s comfortable, beautiful and full of stories

Full StorySponsored

More Discussions

zone_8grandma

western_pa_luann

Related Discussions

Discussion and strategies re current stock market drop

Q

OT: Any way to profit from current market?

Q

Nothing Is Exempt From This Economic Downturn

Q

Current State of Real Estate Market June 20

Q

alphacat

Chemocurl zn5b/6a Indiana

duluthinbloomz4

3katz4me

chelone

behaviorkelton

duluthinbloomz4

cheerful1_gw

chisue

jakkom

chisue

joyfulguy

jakkom

chisue

joyfulguy

chisue

jakkom

chisue

chelone

JimOriginal Author

zone_8grandma

User

jakkom

kframe19

chelone

joyfulguy

behaviorkelton

dreamgarden

dreamgarden

Pipersville_Carol

joyfulguy

jakkom

ian_bc_north

dreamgarden

jakkom

dreamgarden

bethesdamadman

joyfulguy

jakkom

bethesdamadman

Pipersville_Carol

jakkom