Credit Scores and Open Credit Cards

stellar1

17 years ago

Related Stories

DECORATING PROJECTSDIY Home: Add Open-Shelf Storage for Less Than $40

Got an empty wall and overflowing cabinets and drawers? Curb the clutter with inexpensive open shelves you can install in a day

Full Story

BATHROOM DESIGNDream Spaces: Spa-Worthy Showers to Refresh the Senses

In these fantasy baths, open designs let in natural light and views, and intriguing materials create drama

Full Story

BATHROOM DESIGNBliss Out in Your Bath: 18 Ways to 'Spa Up' Your Bathroom

Can't get to the spa? Bring it to you. You can spend the saved money on new towels, candles and lavish lathers

Full Story

HOME TECH7 Ways to Charge Up and Connect After Disaster

Products and tips for communicating and keeping essential items running till the power's back on

Full Story

TRAVEL BY DESIGN10 Ideas for Packable Decor From Your Travels

It's fun to decorate with finds from a trip — but not so fun to lug them home. These ideas are affordable and easy on the suitcase

Full Story

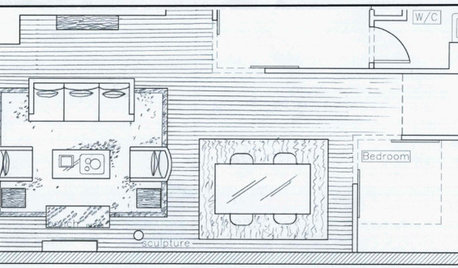

DECORATING GUIDES9 Planning Musts Before You Start a Makeover

Don’t buy even a single chair without measuring and mapping, and you’ll be sitting pretty when your new room is done

Full Story

DINING ROOMSUnconventional Dining Room Seating

Create Your Own Eclectic Set With Wingbacks, Benches, Slipcovers and More

Full Story

MOVING5 Risks in Buying a Short-Sale Home — and How to Handle Them

Don’t let the lure of a great deal blind you to the hidden costs and issues in snagging a short-sale property

Full StoryMore Discussions

uafly1

kittiemom

Related Discussions

Question on Credit Score Report

Q

Estimate of future credit score

Q

Credit report madness!!! Score might not be good afterall.

Q

Cancelling credit cards & credit score

Q

stellar1Original Author