When a kid, using outside-source money, and a Dad/Mom have identical balances in an identical bank account throughout a year, the kid will almost always retain more income from it than the parent.

How come?

In most cases, the kid's annual income is too small for her/him to have acquired the silent partner in our life-business that (almost) all of us adults have acquired over the years, the Income Tax people.

So he can keep all of the interest earned ... but his parents can keep only the residue after paying income tax on it.

A number of the situations discussed here reflect the situation in Canada and residents of other countries may have different issues to deal with.

In Canada, if parents/grandparents gave the initial money to the kid that s/he invested ... the giver continues tax-liable on that portion of income that the kid's investment produces. But - not so if it's capital gain!

So ... in the early years of a child's life, they should invest the money that they give to her/him in stocks with good growth prospects, but using all earnings to grow the company, not paying dividends, with the family-related gift giver liable to pay the tax on it ... usually at high rate.

Then the kid liquidates the investment at post-secondary education time, being taxable at capital gain rate, and at low total income level, so probably tax-liable at low level, if at all.

On the day that we start work, we have hands and brain at work ... and no money to put to work.

As we develop some investments, the income that they produce are added to our base (employment) income ... as we are not about to give up our employment income. So current income on investments throughout our earning years is almost always added to our regular income ... and taxed at our top marginal rate.

So many investment advisors here say that means that we should make use of tax-deductible investments into tax-deferred retirement systems during those earning years, especially in the early ones.

Some of us feel that there may be, for Canadians, a preferable system to use, but ours is a minority opinion. Pay the tax ... which the majority say means that we'll always have less money available to invest, and can never get ahead of the folks who use the deduction and have the whole pre-tax amount available to invest.

If an investor can find types of invesment where there is a lower level of taxation during those years, in a number of cases that may be a preferable system to use.

We are not about (can't afford) to cease our employment, so that is our base income and investment income is on top, taxed at marginal rate.

But in this area, some kinds of investment income are taxed at lower current rates, so some of us feel it useful to aim at making use of some of those provisions of the tax act. Not only that ... when we borrow to invest aiming at producing income, the interest cost is deductible.

And, while we may have deducted the dollars invested in retirement accounts, each dollar withdrawn becomes taxable, but some other types of invested asset can be withdrawn at much lower tax rate.

As we appraoch retirement with fewer years till we plan to be drawing some of those retirement assets, it becomes more important, in some people's eyes, to invest where the asset is "safer".

On the day that we retire, a different money management system takes place. Now, we have brain and money at work earning income ... but no requirement for hands to work. If we don't have enough pension and investment income to meet our needs ... we can't afford to retire. And we'd better not forget to calculate for some erosion of the value of assets annually due to inflation.

From that point on, our pension and investment income is our base income.

After retirement, most of us with pension and investment income feel that there are lots of other interesting and worthwhile things to do rather than working.

But we'd better not forget to take the erosion of value of our assets by inflation into account, before we decide to say good-bye to employment income entirely.

If we choose to earn employment income, that is added to our regular income ... and now it gets taxed at top marginal rate (actually, it always was taxed at a fairly high rate).

In this area, a tax credit that is available to us past age 65 is reduced as our income increases, and one of our persions begins to be reduced when we have income over about $55,000., and is completely lost when our income is in the mid $80,000.s.

Another deterrent to continuing to earn employment income.

We are required to stop investing into our tax-deferred retirement account at age 71, and to begin taking annual payouts then, as well, taking out larger percentages annually from then on until we remove 20% annually at age 90.

A number of these issues relate to the Canadian siuation and residents of other countries may have different issues to deal with.

All of which leads a number of retirees to conclude that it's not worth it to earn employment income after retirement.

Especially since, as I've shown in another thread, a single Canadian with only one kind of investment income can earn up to $49,850. before being required to pay one cent of income tax. But that "taxpayer" who happens to be a resident of Ontario would have to pay $600. Ontario Health fee.

That "taxpayer" could earn more than that if there's a low-income spouse, and/or charitable or political contributions, and (fairly high) eligible medical expenses, but don't forget that a major portion of Canadian medical services are provided without direct fee paid by the patient.

ole joyful

C Marlin

joyfulguyOriginal Author

Related Discussions

Does Fica And SS get 'taken' when I file my taxes?

Q

Banking Crisis Entering a New Stage?

Q

How Many Sources Of Income Do You Have

Q

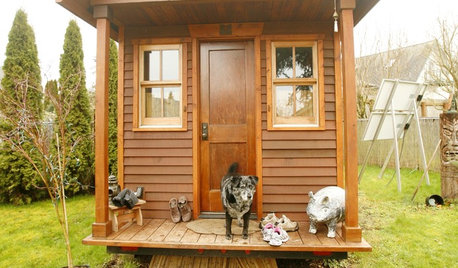

Need income: Add mini kitchen or bath??

Q