how to be NOT married (finances)

behaviorkelton

10 years ago

Related Stories

LIFEWe Can Work It Out: Living (and Cleaning) Together

Run a household without fussing and fighting with these ideas for how to work together on household chores

Full Story

FUN HOUZZ14 Things You Need to Start Doing Now for Your Spouse’s Sake

You have no idea how annoying your habits at home can be. We’re here to tell you

Full Story

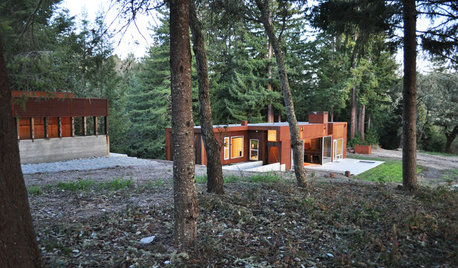

HOUZZ TOURSHouzz Tour: A Modern Getaway Nestled in the Trees

Nature views and bold materials star in a California vacation house for Chicago newlyweds

Full Story

BUDGETING YOUR PROJECTDesign Workshop: Is a Phased Construction Project Right for You?

Breaking up your remodel or custom home project has benefits and disadvantages. See if it’s right for you

Full Story

LIFESo You're Moving In Together: 3 Things to Do First

Before you pick a new place with your honey, plan and prepare to make the experience sweet

Full Story

THE POLITE HOUSEThe Polite House: Can I Put a Remodel Project on Our Wedding Registry?

Find out how to ask guests for less traditional wedding gifts

Full Story

LIFEA Therapist’s Guide to Dealing With Conflict at Home

Piles of laundry and dirty dishes are a part of cohabitating. Here’s how to accept it and move forward

Full Story

MOST POPULARThree Magic Words for a Clean Home and a Better Life

Not a natural tidying and organizing whiz? Take hope in one short phrase that can change your life forever

Full Story

LIFE10 Reasons to Be Happy You’re a Renter

Homeownership has many benefits, but there are upsides to not owning a home too

Full Story

COMMUNITYSimple Acts: The Unsung Power of a Good Neighbor

There are many ways to be a good neighbor, and they're often easier than you think

Full StorySponsored

More Discussions

maifleur01

emma

Related Discussions

How do we finance a build?

Q

Do svgs int rates, stock market change house financing?

Q

How to finance a remodel?

Q

Financing question - how much was your "loan origination" fee?

Q

Evenie

behaviorkeltonOriginal Author

sushipup1

emma

Elmer J Fudd

bob_cville

duluthinbloomz4

louisianagal

behaviorkeltonOriginal Author

joaniepoanie

sushipup1

Elmer J Fudd

modern life interiors

jakkom

randy427

emma

JoppaRich

Elmer J Fudd

jakkom

emma

Elmer J Fudd

dockside_gw

jakkom

User

jakkom

emma

sushipup1

Elmer J Fudd

emma

sushipup1

Elmer J Fudd

maifleur01

azmom

jakkom

Acadiafun