property tax assessment vs homestead credit

lynnt

15 years ago

Related Stories

MOVING5 Risks in Buying a Short-Sale Home — and How to Handle Them

Don’t let the lure of a great deal blind you to the hidden costs and issues in snagging a short-sale property

Full Story

LIFECould You Be a Landlord?

Sure, the extra income would be great. But jumping blindly into owning a rental property could be disastrous. Here's what you need to know

Full Story

GREEN BUILDINGGoing Solar at Home: Solar Panel Basics

Save money on electricity and reduce your carbon footprint by installing photovoltaic panels. This guide will help you get started

Full Story

TASTEMAKERSNew Series to Give a Glimpse of Life ‘Unplugged’

See what happens when city dwellers relocate to off-the-grid homes in a new show premiering July 29. Tell us: Could you pack up urban life?

Full Story

MOVINGHow to Avoid Paying Too Much for a House

Use the power of comps to gauge a home’s affordability and submit the right bid

Full Story

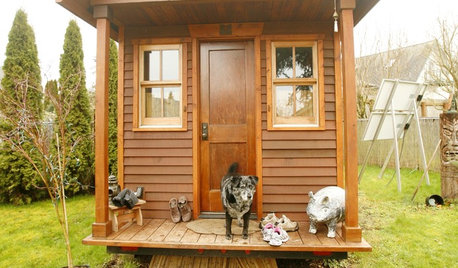

SMALL SPACESLife Lessons From 10 Years of Living in 84 Square Feet

Dee Williams was looking for a richer life. She found it by moving into a very tiny house

Full Story

REMODELING GUIDESShould You Remodel or Just Move?

If you're waffling whether 'tis better to work with what you've got or start fresh somewhere else, this architect's insight can help

Full Story

TRADITIONAL ARCHITECTUREHow to Research Your Home's History

Learn what your house looked like in a previous life to make updates that fit — or just for fun

Full Story

ARCHITECTURE8 Modern Hamptons Homes Buck Convention

Defying the overblown architecture popular in this affluent Long Island area, these modern residences take a more modest approach

Full Story

LIFEHow to Decide on a New Town

These considerations will help you evaluate a region and a neighborhood, so you can make the right move

Full StorySponsored

More Discussions

devorah

lynntOriginal Author

Related Discussions

How to minimize property taxes?

Q

IRS Tax Credit Overrated, Overhyped?

Q

Please explain property taxes after buying...

Q

Speaking of property taxes - how is it determined?

Q

Mo