FSAs (flexible spending accounts)

cathyll

19 years ago

Related Stories

HOUZZ TOURSHouzz Tour: A Manhattan Studio Opens to Flexibility

A dilapidated prewar studio becomes an efficient, adaptable living space filled with sunshine in space-hungry New York City

Full Story

BATHROOM DESIGN9 Surprising Considerations for a Bathroom Remodel

Don't even pick up a paint chip before you take these bathroom remodel aspects into account

Full Story

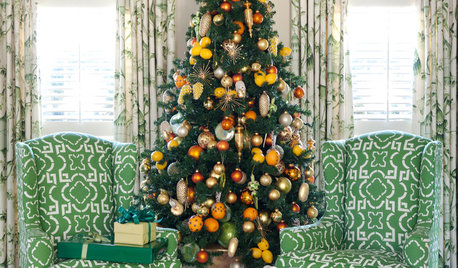

CHRISTMASReal vs. Fake: How to Choose the Right Christmas Tree

Pitting flexibility and ease against cost and the environment can leave anyone flummoxed. This Christmas tree breakdown can help

Full Story

SELLING YOUR HOUSEA Moving Diary: Lessons From Selling My Home

After 79 days of home cleaning, staging and — at last — selling, a mom comes away with a top must-do for her next abode

Full Story

KITCHEN DESIGNStay Cool About Picking the Right Refrigerator

If all the options for refrigeration leave you hot under the collar, this guide to choosing a fridge and freezer will help you chill out

Full Story

LIFE10 Reasons to Be Happy You’re a Renter

Homeownership has many benefits, but there are upsides to not owning a home too

Full Story

PETS5 Finishes Pets and Kids Can’t Destroy — and 5 to Avoid

Save your sanity and your decorating budget by choosing materials and surfaces that can stand up to abuse

Full Story

KITCHEN DESIGN5 Favorite Granites for Gorgeous Kitchen Countertops

See granite types from white to black in action, and learn which cabinet finishes and fixture materials pair best with each

Full Story

HOME TECHTech to the Rescue: How to Get Stolen Gadgets Back

Catch any crook who dares steal devices from your home with recording and tracking technology that's easy to use

Full Story

GARDENING GUIDESHow to Install a Drip Irrigation System

Save time and water with a drip watering system in your vegetable garden — a little patience now will pay off later

Full StorySponsored

More Discussions

good36

Nancy in Mich

Related Discussions

Attn: Owner Builders: How much did you spend per sq ft on home?

Q

Planning for retirement - if, supposedly, the time is flexible

Q

28 Tips To Save Money

Q

If you have a healthcare flexible spending account ...

Q

kittiemom

cathyllOriginal Author

steve_o

cathyllOriginal Author

good36

Nancy in Mich

good36

steve_o

roseyp8255

Vickey__MN

kksmama

cseyer