What should I do?

memee

16 years ago

Related Stories

FUN HOUZZEverything I Need to Know About Decorating I Learned from Downton Abbey

Mind your manors with these 10 decorating tips from the PBS series, returning on January 5

Full Story

INSIDE HOUZZInside Houzz: Updates to the Houzz App for iPhone and iPad

With a redesign and new features, the Houzz app is better than ever

Full Story

LIFEYou Said It: ‘Just Because I’m Tiny Doesn’t Mean I Don’t Go Big’

Changing things up with space, color and paint dominated the design conversations this week

Full Story

DECORATING GUIDESThe Dumbest Decorating Decisions I’ve Ever Made

Caution: Do not try these at home

Full Story

BATHROOM MAKEOVERSWhat I Learned From My Master Bathroom Renovation

Houzz writer Becky Harris lived through her own remodel recently. She shares what it was like and gives her top tips

Full Story

FEEL-GOOD HOME12 Very Useful Things I've Learned From Designers

These simple ideas can make life at home more efficient and enjoyable

Full Story

KITCHEN COUNTERTOPSWhy I Chose Quartz Countertops in My Kitchen Remodel

Budget, style and family needs all were taken into account in this important design decision

Full Story

KITCHEN CABINETSWhy I Combined Open Shelves and Cabinets in My Kitchen Remodel

A designer and her builder husband opt for two styles of storage. She offers advice, how-tos and cost info

Full Story

WINTER GARDENING6 Reasons I’m Not Looking Forward to Spring

Not kicking up your heels anticipating rushes of spring color and garden catalogs? You’re not alone

Full Story

THE POLITE HOUSEThe Polite House: Can I Put a Remodel Project on Our Wedding Registry?

Find out how to ask guests for less traditional wedding gifts

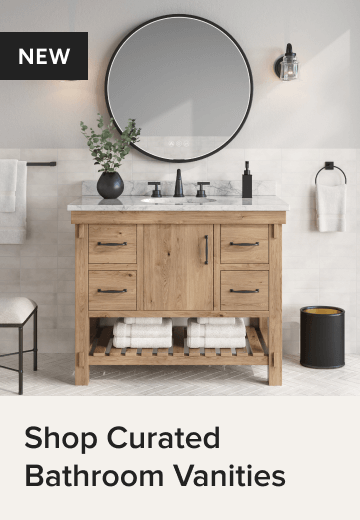

Full StorySponsored

Professional Remodelers in Franklin County Specializing Kitchen & Bath

More Discussions

zone_8grandma

Jonesy

Related Discussions

Do I have rust and if so, what should I do?

Q

I burned my rose plant with homemade pesticide. What should I do?

Q

I’ve just rescued this plant, what should I do?

Q

Starting w/a blank slate (new build!) - What should I do and not do?

Q

3katz4me

joyfulguy

littlebug5

memeeOriginal Author

azzalea