property taxes

joe_mn

17 years ago

Related Stories

REMODELING GUIDESArchitecture Pays Tribute to the Tax Man

Skipping taxes doesn't always mean skipping the country. These architectural features let owners avoid certain taxes without leaving home

Full Story

REMODELING GUIDESDesign Workshop: Is an In-Law Unit Right for Your Property?

ADUs can alleviate suburban sprawl, add rental income for homeowners, create affordable housing and much more

Full Story

LIFECould You Be a Landlord?

Sure, the extra income would be great. But jumping blindly into owning a rental property could be disastrous. Here's what you need to know

Full Story

MOVING5 Risks in Buying a Short-Sale Home — and How to Handle Them

Don’t let the lure of a great deal blind you to the hidden costs and issues in snagging a short-sale property

Full Story

ARCHITECTUREExploring Architecture: Discover the Secrets of Georgian Style

What gives a Georgian property its distinctive character? Take a look at the features that mark this architectural era in Britain and beyond

Full Story

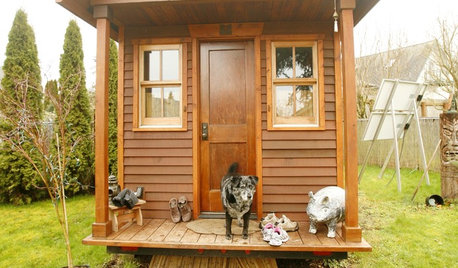

TINY HOUSESHouzz Tour: A Custom-Made Tiny House for Skiing and Hiking

Ethan Waldman quit his job, left his large house and spent $42,000 to build a 200-square-foot home that costs him $100 a month to live in

Full Story

SMALL SPACESLife Lessons From 10 Years of Living in 84 Square Feet

Dee Williams was looking for a richer life. She found it by moving into a very tiny house

Full Story

LIFECondo, Co-op, Townhouse, TIC — What's the Difference?

Learn the details about housing alternatives so you can make a smart choice when buying a home

Full Story

HOUZZ TOURSHouzz Tour: Cozy and Playful in Cape Cod

Casual comfort meets whimsical architectural features in this Massachusetts vacation home with eye-popping views

Full Story

LIFE10 Reasons to Be Happy You’re a Renter

Homeownership has many benefits, but there are upsides to not owning a home too

Full StorySponsored

More Discussions

what_now

jannie

Related Discussions

Ga area with low property taxes

Q

Can we talk about real estate property taxes?

Q

Property taxes in TX

Q

Access, Easements & Property Taxes

Q

kudzu9

kudzu9

dadoes

bushleague

jillnj4

sharon_sd

chisue

chelone

joe_mnOriginal Author

dadoes

qdognj

minet

steve_o

western_pa_luann

chelone

aphilla

hilltop_gw

steve_o

dadoes

chelone

dadoes

Chemocurl zn5b/6a Indiana

acdesignsky

davidandkasie

housenewbie

rivkadr

nancylouise5me

rrah

celticmoon

kitchendetective

cheerful1_gw

western_pa_luann

talley_sue_nyc

coolvt

VickiM324

Stocky

cheerful1_gw

Vivian Kaufman

zone_8grandma

cissado

terrig_2007