Construction Loan.. Purchase Price vs. Assessed Value

njbuilding143

10 years ago

Related Stories

SELLING YOUR HOUSE10 Ways to Boost Your Home's Resale Value

Figure out which renovations will pay off, and you'll have more money in your pocket when that 'Sold' sign is hung

Full Story

MOST POPULAR5 Remodels That Make Good Resale Value Sense — and 5 That Don’t

Find out which projects offer the best return on your investment dollars

Full Story

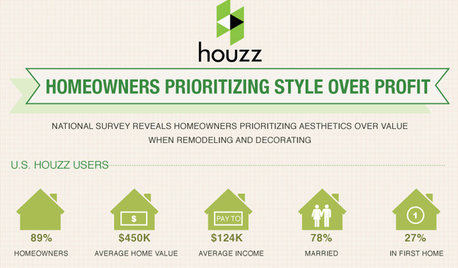

Houzz Survey: Livability Trumps Home Value

Increasing home value comes in a distant second among those planning home improvements. Many plan to do some of the work themselves

Full Story

GREEN BUILDINGInsulation Basics: Heat, R-Value and the Building Envelope

Learn how heat moves through a home and the materials that can stop it, to make sure your insulation is as effective as you think

Full Story

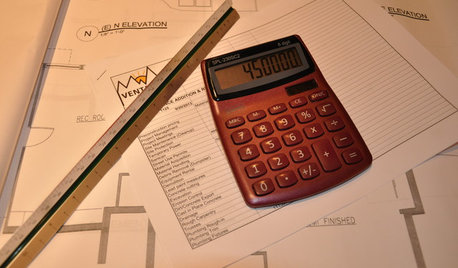

CONTRACTOR TIPSLearn the Lingo of Construction Project Costs

Estimates, bids, ballparks. Know the options and how they’re calculated to get the most accurate project price possible

Full Story

REMODELING GUIDESConstruction Timelines: What to Know Before You Build

Learn the details of building schedules to lessen frustration, help your project go smoothly and prevent delays

Full Story

BUDGETING YOUR PROJECTConstruction Contracts: What to Know About Estimates vs. Bids

Understanding how contractors bill for services can help you keep costs down and your project on track

Full Story

BUDGETING YOUR PROJECTDesign Workshop: Is a Phased Construction Project Right for You?

Breaking up your remodel or custom home project has benefits and disadvantages. See if it’s right for you

Full Story

REMODELING GUIDESWhat to Consider Before Starting Construction

Reduce building hassles by learning how to vet general contractors and compare bids

Full Story

DECORATING GUIDES7 Home Purchases Worth the Splurge

Make buyer's remorse over furniture, textiles and more a thing of the past with this wise purchasing advice

Full StoryMore Discussions

LawPaw

njbuilding143Original Author

Related Professionals

Four Corners Architects & Building Designers · Oakley Architects & Building Designers · Evans Home Builders · Santa Cruz Home Builders · Troutdale Home Builders · Wilmington Home Builders · Converse General Contractors · Deer Park General Contractors · Gallatin General Contractors · Geneva General Contractors · Hermitage General Contractors · Oneida General Contractors · Owosso General Contractors · Panama City General Contractors · Rohnert Park General ContractorsMFatt16

jenswrens

MFatt16

nostalgicfarm

njbuilding143Original Author